The Calm Before the Snap: Hidden Convexity in Chinese Credit

"There are no markets without defaults. There are only defaults the Party has chosen not to let appear."

The Chinese onshore corporate credit market seems to have stopped producing defaults altogether: in the first six months of 2025, only one official default was recorded down from three in 2024 and twenty-one during the same period in 2023. That’s a further 33% decline year-over-year and a dramatic 90% collapse over two years. But this sharp reduction appears to be less the result of genuine structural improvement and more the product of deliberate intervention.

Supporting this view, over 100 cases of non-transparent maturity extensions were reported in the first half of 2025 across Wealth Management Products (WMPs) and trust vehicles key components of the so-called shadow banking system many of which were restructured without formal disclosure or involvement of end beneficiaries.

At the same time, the Financial Stability Bureau issued at least three confidential directives to regional banks and major trust managers during Q1 2025, urging them to sustain distressed vehicles via extraordinary credit lines, technical moratoria, and cross-support among affiliated entities. In at least two instances, local authorities covered potential losses using municipal emergency funds, temporarily reducing fiscal transparency to avoid triggering formal defaults.

Furthermore, the number of public reports on trust conditions dropped by 70% compared to 2023, a sign of intensified information control. These developments reinforce the hypothesis that the near-disappearance of defaults is not a signal of stability but rather the result of a coordinated suppression of visible risk.

This deceptive calm is the byproduct of a regulatory containment strategy orchestrated by Chinese authorities to prevent systemic risk from surfacing. Through forced maturity extensions, the imposition of optimistic narratives, and pressure on trust managers to keep products alive despite underlying illiquidity, an artificial distortion of perceived riskhas been manufactured. These measures do not resolve the system’s structural weaknesses—they merely delay the detonation, compressing volatility and building latent pressure beneath the surface.

The disappearance of defaults, therefore, is not a sign of health. It is likely the effect of artificial risk repression, which amplifies hidden convexity.

With a shadow banking system still bloated with illiquid WMPs, an opaque network of off-balance-sheet trusts tied to indebted municipalities, and toxic rollover mechanisms that prevent genuine price discovery, China is compressing instability into a high-tension systemic spring. Every attempt to preserve the illusion of stability adds new layers of invisible fragility, increasing the likelihood of an abrupt and nonlinear release.

Using the proprietary Quantis convexity model, we’ve applied our analytical lens to the anomalies of the Chinese onshore market. What we found are five key vulnerabilities and it is their interaction, as we will explore in detail, that generates a convex distribution of outcomes, with a systemic left-tail dangerously neglected by traditional linear models. The vanishing of defaults is not just a statistical anomaly it’s a warning sign that reveals a deeper distortion in the market’s price discovery mechanism. In a functioning market, defaults serve as a form of natural selection for risk. When they suddenly disappear, as in the Chinese case, it often means that something usually the State is intervening to control the narrative of stability.

It’s precisely this forced suppression of risk signals that precedes the worst crises. Not because fundamentals are improving, but because confidence is artificially inflated and reality gets compressed. And when the signal returns, it does so with amplified force.

The disappearance of defaults is therefore not a sign of resilience, but the most powerful leading indicator of a crisis driven by confidence and narrative breakdown — not because it is absent, but because of what it silently reveals.

Protection costs remain low for now. But the window is closing fast.

CONTEXT AND OBSERVED ANOMALY

Technical Note: How Corporate Debt Flows Through Trusts and WMPs

Chinese companies especially in real estate and infrastructure have massively funded themselves through two key components of the shadow banking system: trusts and Wealth Management Products (WMPs). These vehicles collect funds from investors, often retail, promising yields higher than traditional deposits.

Trusts, managed by specialized firms, funnel money into high-risk projects.

WMPs, sold by banks, lend to firms locked out of formal credit channels.

The resulting debt is often off-balance-sheet and opaque. When companies are unable to repay, these products are simply rolled over, maturities are extended, and losses are hidden. This creates the illusion of stability: no official defaults, but a mountain of frozen risk waiting to detonate.

Since 2023, onshore corporate defaults in China have collapsed to record lows:

In H1 2023: 21 official defaults were recorded.

In 2024: that number fell to 3, an 86% drop.

In H1 2025: just 1 official default, a near-total disappearance of formal risk.

Meanwhile, exposure through trusts and WMPs remains high, but real problems are no longer publicly acknowledged. These instruments remain illiquid, yet are automatically renewed, even as inflows weaken or vanish altogether. Authorities, through political pressure and information control, uphold a positive narrative to avoid panic.

In practice:

Product maturities are perpetually extended, with no check on whether underlying assets are actually solvent.

This mechanism has replaced normal market functioning, where prices would reflect actual risk.

What This Means:

Illiquid instruments (trusts, WMPs, asset management plans) no longer reflect real losses.

The perpetual rollover mechanism has effectively eliminated price transparency.

Outcome: Systemic risk hasn’t disappeared — it’s merely been swept under the rug.

What remains is an illusion of stability, masking growing fragility, poised to emerge in sudden, nonlinear fashion.

QUANTIS DIAGNOSIS – Identified Systemic Risks

Default Repression:

The apparent decline in corporate failures does not reflect a genuine improvement, but rather an artificial suppression of adverse events, enabled through off-market mechanisms.Toxic Leverage in Credit Vehicles:

Instruments like trusts and Wealth Management Products (WMPs) continue to operate with high leverage and minimal transparency, reinforcing systemic fragility beneath the surface.Inter-vehicle Financial Contagion:

The tight interconnection between trusts, local banks, and municipalities creates a web of vulnerabilities capable of rapidly transmitting shockwaves across the entire financial system.Narrative and Confidence Breakdown:

Market confidence is built on a carefully constructed narrative. If this narrative fractures, the result may be an uncontrolled deleveraging spiral.

Policy Reversal Risk (State Support Withdrawal):

State intervention remains implicit and ambiguous. A sudden withdrawal or weakening of support could trigger a collapse in confidence, destabilizing the entire shadow credit complex.

QUANTIS STREAM – Layered Systemic Observations

Debt:

We have identified a growing pattern of maturity extensions without public disclosure or formal distress signals— a clear indicator of masked deterioration in credit quality.Flows:

Analysis of rollover behaviors and shadow credit channels points to increasing redemption pressures, countered by regulatory barriers and distortionary incentives that suppress risk visibility.Policy:

The official narrative oscillates between reassurance and opacity. Institutional communication is calibrated to prevent panic, but at the cost of rising ambiguity about actual backstops.Multiples:

High Yield spreads remain compressed relative to macro and sectoral fundamentals, suggesting a mispricing of risk that may prove dangerous under stress scenarios.Mechanisms:

The informational ecosystem is subject to tight filtering, making accurate due diligence increasingly difficult. The suppression of independent analysis and critical reporting reduces the market’s ability to respond preemptively.

In summary, these signals depict a system that has not improved it has simply become harder to read.

Reduced transparency, narrative management, and the absence of true price discovery have created an environment where risk is not resolved it’s concealed

RIM MODELING – Simulated Scenarios

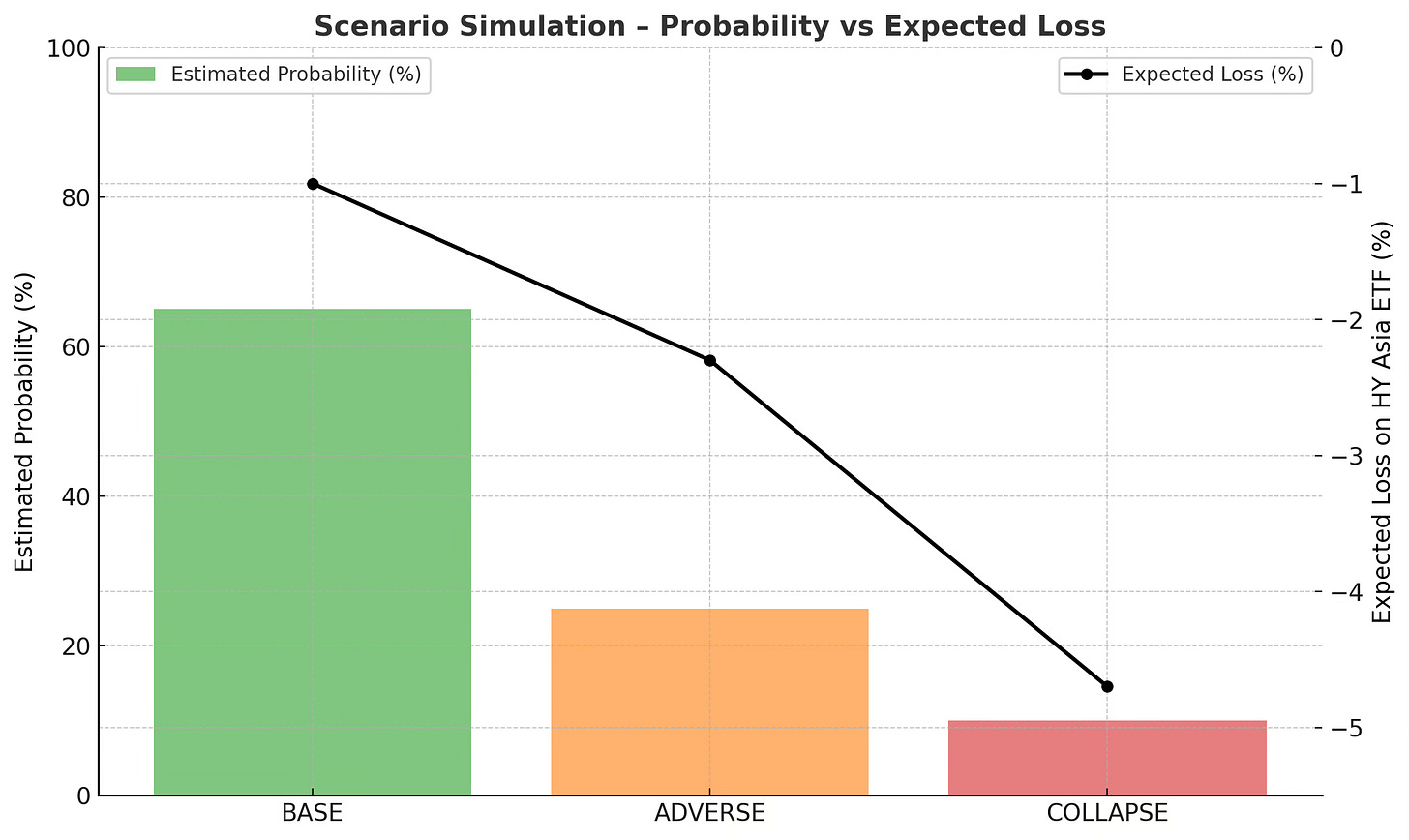

As part of the Quantis modelling framework, we developed three dynamic scenarios for each of the core systemic risks identified, integrating macroeconomic, behavioral, and policy-driven variables. These are not static snapshots, but evolving trajectories each with its own probability and estimated impact.

BASE SCENARIO

The system manages to maintain a façade of stability through a combination of risk repression, maturity extensions, and narrative management. However, distortions accumulate beneath the surface: rollover mechanisms become structural, trusts operate in a semi-frozen state, and credit continues to circulate without real price discovery. Risk is layered, not eliminated.

ADVERSE SCENARIO

Cracks in confidence begin to show. Investors start questioning the sustainability of shadow credit vehicles. Delays in payments emerge, along with increased redemption pressure. Indebted municipalities struggle to support regional trusts, while some local banks begin to cut exposure. Maturity extensions become more frequent, and the system starts displaying cross-sector stress symptoms.

COLLAPSE SCENARIO

The narrative of control breaks down. A catalyst event such as the default of a systemically important trust triggers a widespread crisis of confidence. Interbank markets contract, liquidity vanishes, and wealth management vehicles are rapidly abandoned by both retail and institutional investors. Risk spreads like wildfire: fast, unpredictable, and uncontainable with conventional tools.

Results Summary

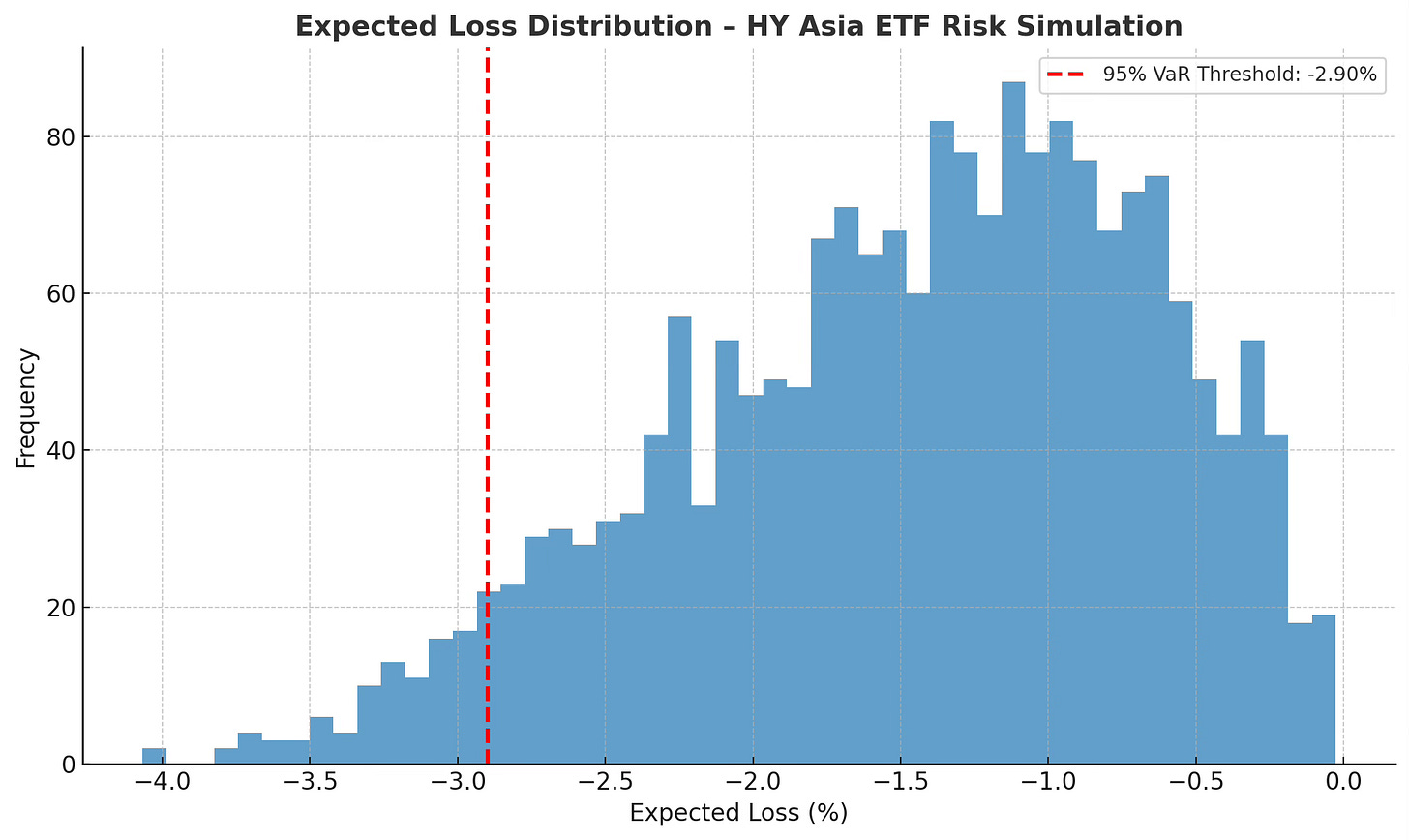

The simulations — over 2,000 iterations calibrated on historical inputs, macro-financial stress, and behavioral patterns produced a highly asymmetric distribution, with a wide and deep left tail.

The expected losses (EL) for the Asia HY ETF range from -1.0% in the base scenario to -4.7% in the collapse scenario. However, the key insight is the non-linearity: losses grow exponentially relative to scenario severity.

The overall probability of extreme events — defined as breaching the 95% VaR threshold is estimated at 15%, with a density peak concentrated in the left tail. This is significantly above what conventional risk models assume, and reflects an accumulation of latent, unaccounted-for fragility.

INTERACTIVE SIMULATION

One of the insights that sparked our investigation was the clear co-movement between signals of distrust in alternative credit vehicles and the tightening of rollover dynamics. We observed that, during periods of media scrutiny or redemption pressure, the system reacted in a nonlinear fashion, almost revealing a web of interconnected fragilities beneath the official narrative.

Our simulations, inspired by this initial observation, did not rely on static scenarios. Instead, we designed a dynamic interaction of risks, modeling chain reactions true feedback loops where the deterioration of a single variable, such as trust confidence, triggered cascading effects on seemingly unrelated areas: interbank funding, implicit state support, and off-balance-sheet bank exposures.

This approach allowed us to capture not only the direction of risk, but also its amplification. We are not dealing with isolated probabilities, but with systemic coalescence scenarios: when multiple vulnerabilities converge, the result is not a linear sum of risks, but a state shift in the entire system

What Does This Chart Really Show?

1. The distribution isn’t symmetric.

The curve leans heavily to the left: meaning there are many more simulations projecting severe losses than moderate losses or gains. This isn’t a stable system. It’s a system precariously tilted, hiding imbalance behind a façade of calm.

2. A swollen left tail.

Standard risk models assume that extreme events are rare. Our model shows the opposite: extreme downside scenarios are disturbingly common.

The probability of breaching the 95% VaR threshold isn’t the textbook 5% it’s closer to 15%.

This means risk isn’t just higher it’s more concentrated, more underestimated, and closer than it looks.

3. The red dashed line is a false boundary.

That’s the 95% VaR the supposed outer edge of risk. But our simulations show it’s routinely breached. And when it is, losses escalate exponentially not gradually.

4. A systemic phase shift — not a linear response.

The system doesn’t unwind slowly.

When confidence in trusts breaks down, it drags everything with it: interbank liquidity, implicit guarantees, off-balance exposures.

The contagion isn’t linear. It’s a cascading collapse across hidden fault lines.

Bottom Line: China’s Onshore Credit Isn’t Stable. It’s Compressed.

This isn’t a case of disappearing risk it’s risk compressed and buried.

Through narrative control, maturity extensions, and implicit backstops, China is building a spring-loaded system.

And when it snaps, it won’t be a gentle decline it will be a nonlinear rupture.

The left tail isn’t noise. It’s the loudest signal — and the one traditional models ignore.

This is the open (condensed) version of the RIM-U model applied to the China case.

The full quantitative simulation including Monte Carlo distributions and convex risk-to-action strategy is available in the Macro Pro Pack.

Want to see risk the way we do?

This is just an operational preview.

Every week, in the Macro Pro Pack (€29/month), you get:

The full RIM model applied to a macro event

The hidden fragilities behind official data

The convex levers that could break the system

👉 Join the Macro Pro Pack — Start thinking antifragile.

Message us in chat for more info.

Disclosure

The content published by Quantis Research is solely intended for informational and strategic-educational purposes.

It does not constitute financial advice, nor does it represent an offer or solicitation to buy or sell any financial instruments, or personalized recommendations under applicable regulations.

All analyses are based on proprietary models (RIM, QOVM) and an epistemological approach focused on systemic fragility and risk convexity.

The material is designed for a sophisticated audience capable of interpreting complex scenarios and critically assessing their applicability.

Any strategy, simulation, or example provided should be understood as an intellectual exercise not as an operational proposal.

Misuse of this information, without proper training or context, may expose investors to significant losses or cognitive distortions.

Quantis Research makes no guarantees regarding the accuracy or timeliness of the data used, and assumes no responsibility for decisions made based on the published analysis.

We strongly recommend consulting a licensed professional before making any financial decisions aligned with your personal risk profile and objectives.